The channel software stack comprises a group of technologies that help companies develop, design, and execute plans to find, recruit, onboard, develop, enable, incent, co-sell with, manage, measure, and report on partners. Delivering automation of indirect sales processes, workflows, and partner programs, channel software is becoming increasingly critical to a brand’s ability to win, serve, and retain its customers and partners. It’s a fast-growing market, with 8.9% growth during COVID-19-impacted 2020, as measured by employee hiring through LinkedIn.

One of the lasting effects of 2020 for the channel will be the changing programs we saw announced throughout the year. Late in the summer, we saw Chuck Robbins announce that Cisco would pursue a 100% subscription/consumption business — accelerated due to COVID-19. A few weeks later, Michael Dell announced the same thing for Dell Technologies — and all seven companies within its family of businesses — pushing $92 billion into a recurring business. Later in the year, IBM jettisoned its storied services business to focus on multicloud, hybrid cloud, and, yes, becoming 100% subscription/consumption. HPE, which has been on the journey for three years with GreenLake, announced that it will be fully there by 2022 — next year! Needless to say, we monitored (and helped) dozens of large vendors announce their trifurcated “build, sell, and service” programs catering to transacting AND nontransacting partners as well as traditional AND nontraditional.

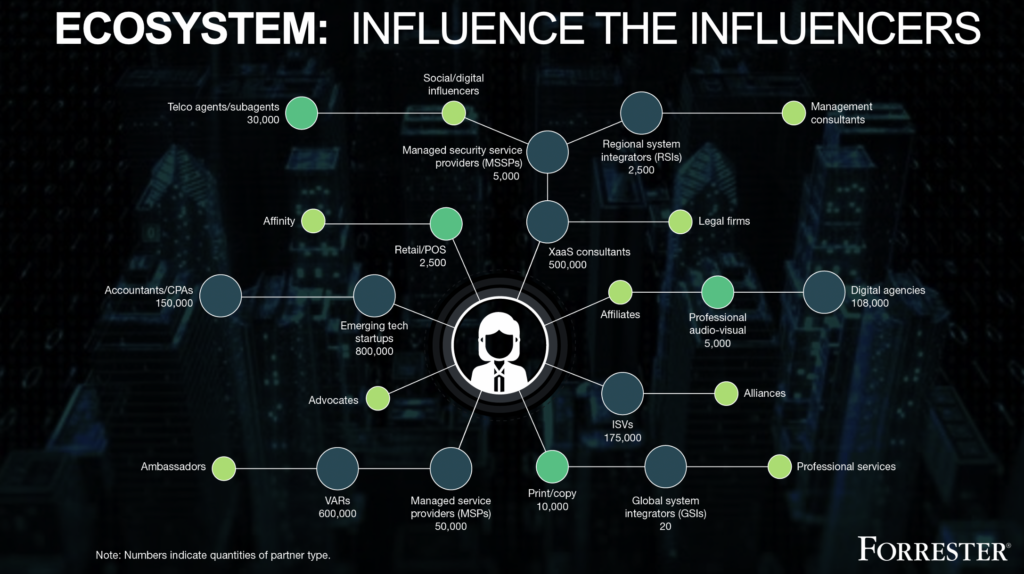

With the rapidly shifting partner landscape, channel leaders and B2B marketers can no longer succeed with manual, human-centric processes or rely on spreadsheets to manage their partner programs. With the trifurcation of partners into influencer, transactional, and retention categories, managing a plethora of concurrent activities without sufficient automation is no longer possible.

In an Accenture survey, 76% of business leaders agree that current business models will be unrecognizable in the next five years — ecosystems will be the main change agent. I personally was involved in a few hundred inquiries (30-minute meetings) with channel professionals who were asking about ecosystem design, recruitment, mapping, management, measurement, enablement programs, and collaboration. The discussions were not about revenue-tiered models and gross-to-net margins but of driving value creation, leveraging network effects, and incubating co-innovation.

The channel software tech stack from 2020 included 18 companies that I put into a new “ecosystem management” bucket. These companies drove $93 million in pure software sales last year, according to my research. The number of companies have doubled this year to 36, and the revenue has almost doubled as well, to $173 million.

This includes:

- Recruitment (at nonlinear scale)

- Attribution (moving from consumer marketing attribution into B2B influencer)

- Account mapping (innovative double-blind data “escrow”-type services)

- Enablement/collaboration (at scale)

- Marketplace and technology/API integrations

- Ecosystem management (transacting/nontransacting and traditional/nontraditional)

To accelerate performance of their partnerships, alliances, and channel ecosystems, companies are evaluating and adopting a range of contributing technologies. Often, the focus of channel technologies is to manage, monitor, and measure the partner journey while improving the overall partner experience (PX). Running a channel program is inherently complex, with hundreds of elements and thousands of moving parts.

Partner programs generate mountains of data from multiple internal and external systems. Data also arrives at unpredictable intervals, is often incomplete or inaccurate, and doesn’t provide an integrated view of each partner or channel performance as a whole. Vendors are quickly overcoming these challenges and beginning to offer AI-infused, real-time, actionable insight. Channel software makes partnering easier, more consistent, and more predictable for both sides of the relationship.

Channel programs can also be very expensive, with front- and back-end discounts, rebates, programs, and incentives costing anywhere between 10% to 50% of the overall sale. The channel software tech stack is made up of 183 companies across seven technology categories that drove $2.8 billion in pure software revenue in 2020 (the vast majority in a software-as-a-service model).

Technology Categories

Partner relationship management (PRM) — Supports the activities required to manage the entire lifecycle of channel partners, including partner targeting, recruitment, onboarding, enablement, engagement, communication, development, co-selling, and co-marketing. It provides critical integrations to back-end systems such as CRM, enterprise resource planning, and marketing tools.

Through-channel marketing automation (TCMA) — Enables partners to engage their customers with a consistent vendor brand experience to create awareness and generate demand. It helps organize and disseminate content and supports the execution of marketing programs, campaigns, and co-branded collateral that drive partner-led demand and accelerate channel lead and pipeline volume and velocity. It includes through-, to-, for-, and with-channel marketing automation.

Channel learning and readiness (CLR) — Supports partner development through the administration, tracking, and delivery of educational training courses and enablement resources, including learning management systems, accreditation and certification management, content management systems, partner portals, communities, and sales enablement.

Channel incentives management (CIM) — Manages design, allocation, tracking, and distribution of financial incentives to the partner ecosystem, including market development funds (MDFs), sales performance incentive funds (SPIFs), co-ops, bonuses, rebates, price protection, channel sales compensation, and loyalty programs. It includes behavioral tactics such as gamification, micro-incentives, and nonmonetary and motivational incentives.

Channel data management (CDM) — Collects, cleanses, and aggregates transactional point-of-sale and inventory data from partners and distributors in a trusted single data asset that enables business and actionable intelligence. It includes new categories of predictive analytics, AI, and machine learning.

Channel marketplaces, financials, pricing, and inventory — Manages indirect-sales-related revenue and costs, determines the correct value of transactions, automates key financial reporting processes, and prevents errors in payment, commission, and rebates. It addresses pricing, inventory planning, gross-to-nets, discounts, compliance, tracking inventory levels, and price protection. Marketplaces are starting to make their mark here.

Channel ecosystem management — Manages the influence, transaction, and retention channels across the entire customer buying journey. It supports recruitment, attribution, account and partner mapping, enablement, collaboration, technology/API integrations, and overall ecosystem management covering all transacting/nontransacting and traditional/nontraditional partners.

The future of channels, alliances, and ecosystems will be anchored on automation, flexibility, scalability, and self-service.

The effective use of technology tools is no longer optional — ecosystems don’t run on spreadsheets!

Original Post: https://www.forrester.com/blogs/channel-software-tech-stack-2021/