The channel technology stack is a group of technologies that brands leverage to manage and improve their indirect sales processes and partner programs. Often, the focus of channel technologies is to make difficult processes easier, automate workflows, measure multi-tier activities, and drive more efficient spending, coverage, and partner communication. The channel industry stack consists of 106 companies across six operational categories. These companies range from Fortune 500 juggernauts such as IBM, Oracle, Salesforce, and SAP to small startups delivering point solutions.

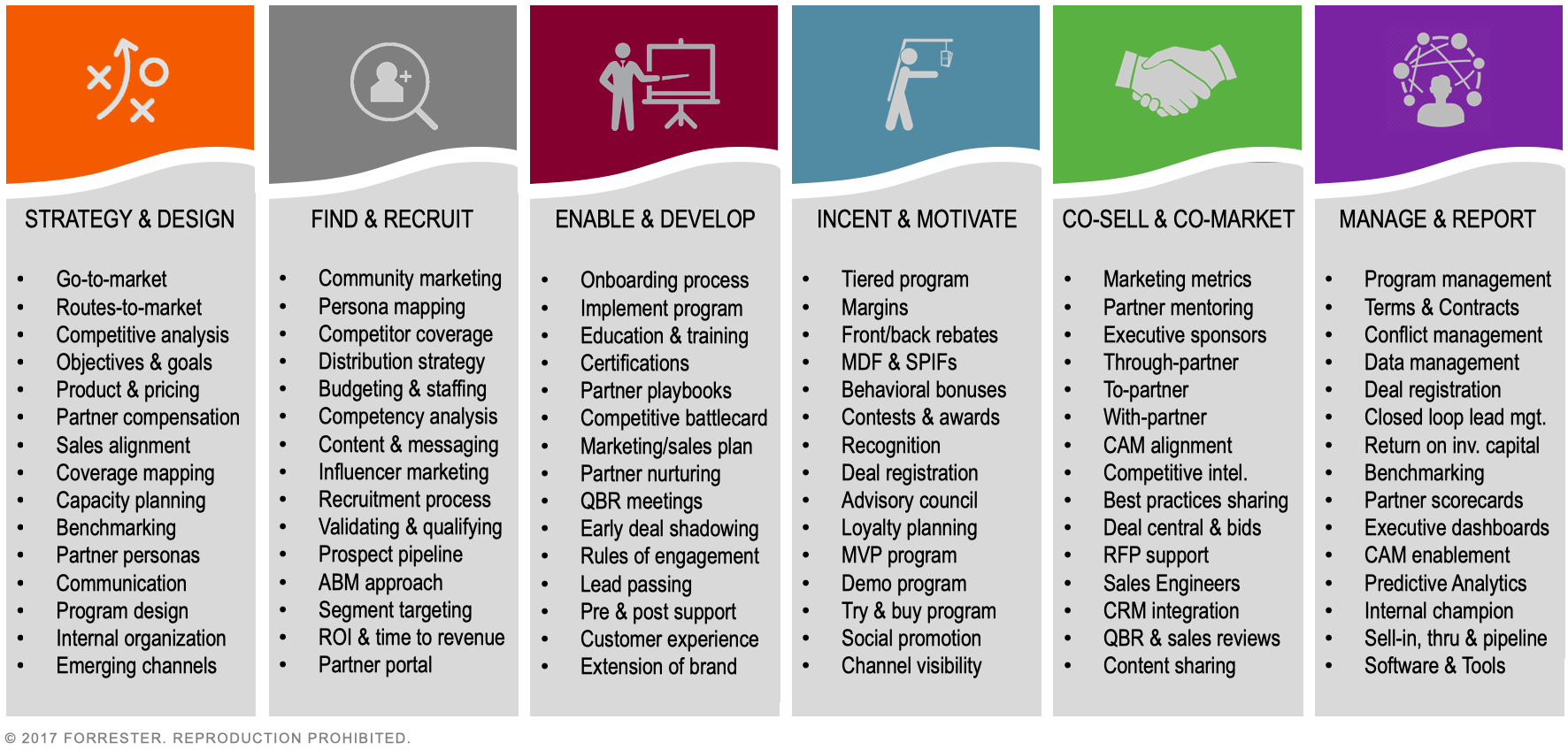

With 90 key operational attributes of a strong channel partner program, no one piece of software can (today) manage all moving parts effectively:

I see this changing during the next few years because product road maps are getting more aggressive, money is flowing in from private equity, and mergers-and-acquisitions activity is catching fire. We are in the middle of a transition period in which the channel software stack is becoming a true horizontal technology.

Winners are starting to emerge.

The channel technology landscape is rapidly evolving, and channel professionals must have a clear understanding of which technologies are most fundamental to their business and program goals, as well as know how technology can help.

Here are the six categories of channel software:

- Partner relationship management. Supports the activities required to manage the entire life cycle of channel partners, including partner planning, segmentation, recruitment, onboarding, training, communication, development, co-selling, co-marketing, and maintenance of profile information. It provides critical integrations to back-end systems such as CRM, ERP, and marketing tools. Twenty-one companies compete around the globe, including Allbound, AppDirect, Aximpro, Channelkonnect, Channeltivity, ChannelXperts, Computer Market Research, Gorilla Toolz, Impartner, LogicBay, Magentrix, Mahindra Comviva, Mindmatrix, myprm, NetSuite, Oracle, Salesforce, TIE Kinetix, Webinfinity, Zift Solutions, and ZINFI. Learn more here.

- Through-channel marketing automation (TCMA). Enables partners to engage their customers with a consistent brand experience, creating awareness, amplifying their brand, and generating demand. It includes through-channel marketing automation, campaign management, social media, syndicated content, microsite development, partner locators, lead management, and routing. A staggering 32 companies compete in TCMA, with focus areas across 27 different industries, including Ansira, Aprimo, Averetek, Balihoo, BrandMaker, Brandmuscle, Bridgeline Digital, Broadridge, CampaignDrive (Pica9), Channel Fusion, ChannelNet, ChannelXperts, Code Worldwide, DemandBridge, Distribion, Elateral, Gage, Impartner, MarcomCentral, Mindmatrix, Netsertive, OneAffiniti, Pageflex, partnermarketing.com (twogether), Promoboxx, RVLVR, Sitecore, SproutLoud, StructuredWeb, TIE Kinetix, Zift Solutions, and ZINFI. Learn more here.

- Channel incentives and program management (CIPM). Manages the design, allocation, tracking, and distribution of financial incentives to the channel partner ecosystem, including market development funds, special payment incentives for fast sales, co-ops, bonuses, rebates, price protection, channel sales compensation, and loyalty programs. Twenty-six companies compete in CIPM, including 360insights, Ambassador, Amplifinity, Aprimo, Apttus, Brandmuscle, Bunchball, Channel360, ChannelAssist, Channel Fusion, Channel Mechanics, Collinson Group, E2open, Fielo, Hawk Incentives, Herald Logic, Hinda Incentives, ITA Group, Loyaltyworks, Maritz, Model N, MTC Performance, Partnerize (Performance Horizon), Perks WW, SproutLoud, and WorkStride.

- Channel data management (CDM). Collects, cleanses, enriches, and aggregates transactional point-of-sale, financial, incentive, and inventory data from partners and distributors into a trusted single data asset that enables actionable business intelligence. It includes new features such as predictive analytics, artificial intelligence, machine learning, and overpayment and fraud detection. Fourteen companies compete in this category, including 360insights, Aximpro, Canalys, ChannelEyes, compuBase, Computer Market Research, E2open, IQBlade, Model N, PartnerOptimizer (SaaSMAX), Q2E, Salesforce, Successful Channels, and TechTarget.

- Partner enablement and onboarding. Supports partner development through the administration, tracking, and delivery of educational training courses and enablement resources, including learning management systems, accreditation and certification management, content management systems, partner portals, communities, and sales enablement. Twenty-six companies offer solutions in this category, including Allbound, Brainshark, Channel360, Channel-EZ, Channel Rocket, CM-Focus, Cornerstone, CSG, Developerprogram.com, Expertus, FISION, IBM, Impact Radius, LeadMethod, Mediafly, MobileForce, NetExam, NitroMojo, PartnerTap, Seismic, Skilljar, Vartopia, WHUT, WorkSpan, Zift Solutions, and Zunos.

- Channel finance, pricing, and inventory. Manages indirect sales pricing, revenue, and costs; determines the correct value of transactions; automates key financial reporting processes; and prevents errors in payment, commission, and rebates. It addresses pricing, inventory planning, discounts, compliance, tracking inventory levels, and price protection. Fourteen companies compete in this category, including AppDirect, ChannelAdvisor, channelcentral.net, Channelkonnect, Computer Market Research, E2open, iasset.com, Model N, Oracle, PROS, SAP, TIE Kinetix, Vendavo, and Vistex.

Running a successful channel program is a complicated endeavor. It can be a thankless one, as well! Trying to do it with antiquated tools and gut instincts isn’t enough anymore. The channel is growing significantly, and brands need advanced (and integrated) purpose-built tools based on the latest technologies such as cloud, mobility, social, predictive analytics, and big data.

Original Post: https://www.forrester.com/blogs/channel-software-tech-stack-2019-infographic/